Directors & Investors Newsletter

Novus Capital Holdings has several exciting things going on. Our charter applications with banking regulators are moving forward with the enthusiastic receipt by regulators which we thought we’d receive. Investor events we’ve held, in addition to our one-on-one meetings with individuals continue to generate a growing list of committed shareholders, as well as many who’ve given their intent to invest but have yet to determine the amount of their investment. We’ve had numerous meetings with third party vendors, as we begin to build essential pieces of our infrastructure and the operating process and have identified some who will be partners in how we operate. It’s an extensive list; Core Processor is yet to be determined, Network Management and Internet Provider will be Bank on IT, third-party loan review and compliance training/audit will be RDK from Tulsa, and we have to pick software providers for loan documentation, deposit documentation, document imaging/storage, communications systems, loan underwriting and report writing are some of the more important areas to select and manage.

Our capital raise continues to expand the Novus shareholder base, which as we know, will greatly contribute to Novus Bank’s growth and achieving our performance targets. Including all committed stockholders we’re about halfway to our initial goal. We have many more prospective investors we’re currently in discussions with. Some have increased their original commitment as the bank begins to take shape. A very attractive option for funding the investment has been for stockholders to utilize their existing IRAs or even certain 401-Ks to roll over funds into a self-directed IRA, using Strata Trust Company or other companies that manage self-directed IRAs to make the investment. It’s money that the investor isn’t likely to touch for a number of years, and given the current stock market environment, isn’t going to see the volatility that some mutual funds have experienced recently.

The typical de novo timeframe from inception to opening the doors is about 18 months. We’re well over halfway into the process. As other banks become aware of our plan, we’ve even been contacted through brokers to see if we’d be interested in acquiring an existing bank. While we remain focused on our de novo business plan, the possibility of acquiring another bank exists, which would help accelerate our growth plan. If a serious opportunity develops, we’ll keep you informed.

This is a good time to be part of the Novus Family!

As 2025 unfolds, we’ve seen reactions to tariffs and policy create some uncertainty in the equities markets. Thinking through the wake of reactions, though, analysts have seen that the current environment has created an awareness for advisors about the need for safer, high-performing private equity investments that are not subject to the volatility of publicly traded stocks. The following are a few articles from market analysts that shed some light on the importance of a safe, high-performing, and diversified equity approach…which is exactly what an equity position in Novus is designed to provide.

From Strata Trust Company…

Diversification and Risk Management. Studies show that diversification can reduce overall portfolio risk. The Modern Portfolio Theory (MPT), developed by Harry Markowitz, posits that a diversified portfolio can offer higher returns with lower risk. Many financial experts support this idea, noting that diversified portfolios tend to perform better during periods of market volatility.

Diversity is an Investor’s Best Defense in Treacherous Times

By Sean Michael Cummings, analyst

True Wealth April 7, 2025

We’ve been living through a record-setting market – but not the good kind of records… Stocks just suffered their worst first quarter of the year since 2022. March was also the worst month for stocks since December 2022. Last week, we saw the market’s worst week of losses in almost five years, going back to the early months of COVID-19. And according to Bloomberg, the stock market just experienced its worst 10 weeks to start any presidency since 2001. But unlike in 2001, the recent crash isn’t due to a bubble bursting. It’s the result of a deliberate economic shock…

After markets closed two weeks ago, President Donald Trump revealed his much-discussed tariff package. The plan included a flat tariff of 10% on all foreign imports, plus higher duties for America’s biggest trade partners. The tariff package shocked Wall Street… and provoked last week’s hasty sell-off.

So far, this administration has been painful for stock investors. And the new tariffs look certain to ring in more volatility from here. But there’s a simple way to protect your portfolio from future shocks. You just need to be strategic about asset allocation.

The Regulatory Climate Is Improving for Small Banks.

Scott Bessent, in his role as Treasury Secretary, has expressed concerns about the impact of financial policy on both large and small banks, arguing that current policies disproportionately benefit larger institutions at the expense of smaller ones. He advocates for more tailored regulations that ease burdens on community banks and foster a more level playing field for all banks, regardless of size.

Here’s a more detailed look at Bessent’s comments:

- Criticism of Current Regulations: Bessent has criticized financial policy for serving large institutions at the expense of smaller ones, particularly community banks. He believes that current regulations, while intended to ensure financial stability, can be overly burdensome for smaller banks, hindering their ability to compete and support local economies.

- Focus on Modernization: Bessent has emphasized the need for modernization of financial regulations, particularly those related to capital requirements. He argues that outdated capital requirements can stifle innovation and economic growth, especially for smaller banks.

- Advocacy for Tailored Regulations: Bessent has called for more tailored regulations that reflect the specific risk profiles of different banking institutions. He believes that applying “commonsense principles” to banking regulations can ease burdens on community banks and allow them to better serve their communities.

- Emphasis on “Main Street”: Bessent has stated that the Trump administration’s financial policies will focus on supporting “Main Street,” meaning the small businesses and community banks that drive economic activity in local areas. He believes that by easing regulatory burdens and fostering a more level playing field, the administration can help these institutions thrive.

- Specific Examples: Bessent has mentioned specific areas where he believes regulations are overly burdensome for smaller banks, including capital requirements for mortgage loans and other exposures that are core to the community bank model. He has also expressed concerns about the impact of regulations on internal controls, including third-party risk management and information security.

- Treasury’s Greater Role: Bessent has stated that the Treasury Department will play a greater role in bank regulation to better balance the costs and benefits of regulations. He believes that the Treasury can play a more active role in ensuring that regulations are fair and efficient, and that they do not unduly burden smaller banks.

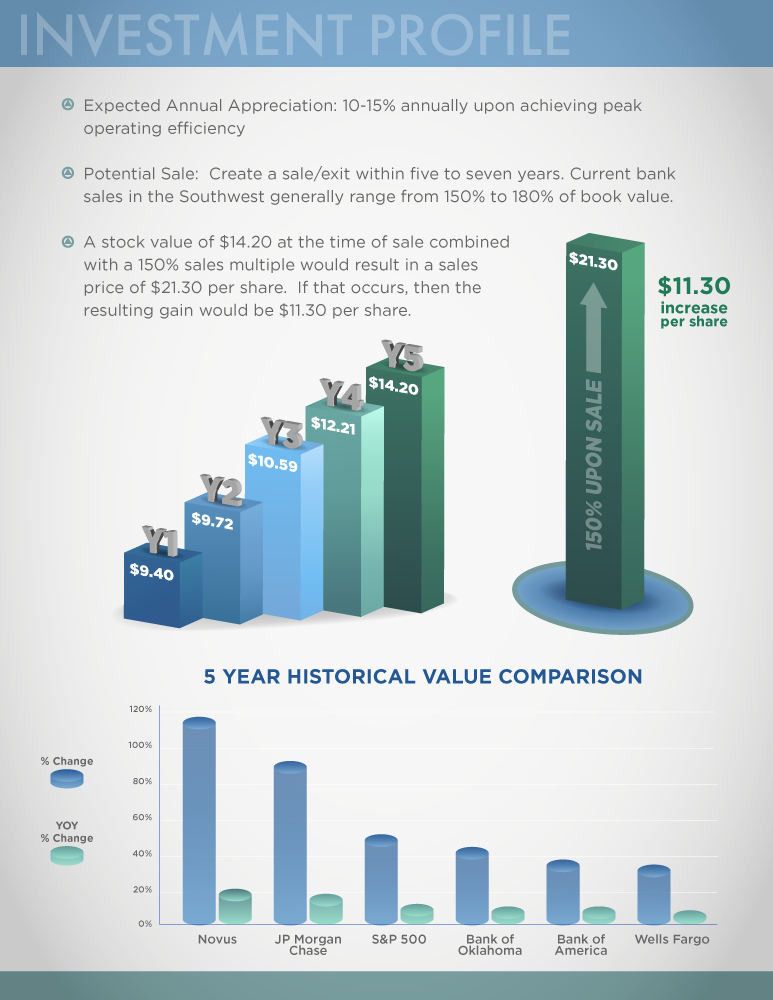

The expected earnings generated by Novus Bank will be reinvested into the capital base in order to create a strong sales multiple. The projected five-year performance of the Novus Bank stock compared to various other bank stocks as well as the S&P 500 over the last five years.

How does this compare with the Dow and S&P? Google AI indicates that over the past ten years the S&P 500 demonstrates an average annual return of around 9.576% (adjusted for inflation). Dow Jones Industrial Average has been 9.6%. Publicly traded bank stocks, as a sector, have also generally performed well. The five-year projections for Novus predict an even better performance. Much of this will stem from existing books of business produced by the Novus Management team over the last few decades. The Novus shareholder base too, will help propel growth which is part of the success formula.

Other Hot Topics

Cyber Security

Cyber Security is always on our minds. Protection of our clients’ personal information and the Bank’s information & systems is one of our top priorities. Novus will take a number of important steps to ensure information security for the bank and our clients.

Novus will contract with an Oklahoma City Based company, BankOnIT (“BOIT”), to manage our Information Technology Network providing system support and solutions. BOIT was formed over 20 years ago and manages technology for over 250 banks nationwide. It is perhaps the most highly regarded Network Manager for Banks in the country. We’re fortunate that it is locally owned and operated. Jim and Mel have used Bank on IT as a vendor for over 20 years.

The company supports over 12,000 users in the 250+ banks it supports. It uses a private cloud and proprietary software, and over the last 12 months, BOIT shows:

- 3 Billion Firewall Events successfully detected and remediated

- 6.2 Million patches and updates applied

- 276,000 support cases resolved

- of all the Malicious Vitus or Ransomware Attempts made on its clients that zero were successful

They have remediated 99.9% of critical vulnerabilities in less than one day. With its redundancy between its OKC and Kansas City facilities, it has 100% uptime commitment. Our partnership with Bank on IT allows us to maintain confidence in Novus Bank’s technology, knowing that our IT is secure, protects the Bank and our clients from IT-related threats, and allows us to deliver personalized, localized and frictionless experience to our customers. Bank on IT can also manage our communications network at a lower cost than most traditional phone network providers.

Novus Capital Holdings, Inc. currently uses the .net domain. Once the bank is approved by regulators and opens, we’ll use a new domain and name. We will use the .bank domain. A .bank domain name can only be obtained by a bank, so bad actors are unable to register one of those domains, making it very difficult to impersonate a legitimate bank. A large percentage of social engineering or phishing attempts come from someone trying to impersonate a bank’s staff members or other bankers.

Charter Application Update

The charter applications with the FDIC and Oklahoma State Banking Department have been successfully submitted and accepted. Both the FDIC and OSBD accepted the applications without requesting additional information, which is a remarkable accomplishment. The investigation process will take approximately five months, during which time we will continue to raise capital and build the operational components of Novus Bank.

Meet the Directors

Continuing our practice of introducing you to the directors of Novus Bank, we feature three more this month:

Laura Brookins Fleet

Attorney | Entrepreneur

Laura Fleet Consulting

Laura Fleet is a leading expert in health care, administrative, and regulatory law, having represented health insurers, providers, and hospital systems for more than twenty-five years as legal counsel. Building on her success as a lawyer, entrepreneur, and lobbyist, she currently serves as president of her own consulting business. She also serves Of Counsel with a prestigious legal firm in Oklahoma City where she delivers comprehensive legal counsel on corporate governance. Mrs. Fleet previously founded a healthcare technology company and served as CEO of that company as she led the company to dramatic revenue and capital growth.

Laura received her Juris Doctor from Oklahoma City University School of Law and is a graduate of Midwestern State University where she earned her bachelor’s degree in criminal justice. She is admitted to practice law in Oklahoma state courts and the United States Court for the Western District of Oklahoma.

Joshua Jenson

CPA | Owner

Joshua Jenson CPA, PC

Joshua Jenson, CPA, has 31 years of public accounting experience in tax in the CPA firm he founded nearly 27 years ago.

Joshua is a licensed CPA in Oklahoma and Texas and a member of the American Institute of CPAs and the Oklahoma Society of CPAs. He serves on the Tax Committee for the Oklahoma Society of CPAs as the past Chairperson of the OSCPA Educational Foundation and was named CPA of the year by his CPA Peers. Joshua Graduated from Abilene Christian University in 1993 with an accounting degree.

Joshua travels the country presenting tax courses to CPAs on the latest tax laws and strategies. The US Chamber of Commerce named him one of the top 10 Small Business Experts to follow. For the last 20 years, he has appeared on local and national news programs and has become a regular tax season guest on several local and national radio programs.

Robert E. Tibbs, Jr., MD

Robert Tibbs, MD, is a neurosurgeon, partner at Neuroscience Specialists in OKC, and extensive investor. Dr. Tibbs’ experience is renowned and includes multiple specialties and accreditations, medical boards, and medical publications. Dr. Tibbs is actively involved in the management of a multi-physician practice. Dr. Tibbs is actively involved in the medical and business community in the Oklahoma City metropolitan area.

Rob received his undergraduate degree from Auburn University. He obtained his medical degree from the University of Alabama School of Medicine in Birmingham, AL. His internship was with the Mayo Graduate School of Medicine and residency through the University of Mississippi Medical Center. Rob did fellowships with University of Mississippi Medical Center and the Wake Forest University School of Medicine.

Dr. Tibbs has delivered numerous lectures around the country and has made nearly 50 presentations to physicians and groups in the U.S and Japan. He has been published in numerous Medical Journals.

One other interesting fact about Dr. Tibbs, is that he is a Certified Sommelier with the WSET diploma. He is the only person in Oklahoma with that diploma.